- June 17, 2023

- Posted by: Idrees Gadriwala

- Category: Tax

No Comments

- Corporate Tax (CT) is a form of Direct Tax which will be levied on Net Profit of Companies, Partnership or individuals earned on their businesses. No tax will be charged on Net Profit up to AED 375,000. On Net Profit exceeding AED 375,000, tax @ 9% will be charged.

- The law has brought some clarity by defining Business, Business Activity. Qualifying Income, Extractive Business, Non-Extractive Natural Resources Business, Qualifying Public Benefit Entity, Exempt Person, Taxable Person, Taxable Income, Related Party, Resident Person, Non-Resident Person, Free Zone, Permanent Establishment, Investment Manager, Family Foundation, Foreign Tax Credit, Accounting Income, Exempt Income, Tax Loss, Foreign Permanent Establishment, Tax Group, Administrative Penalties, etc. It is very important to understand the implications for proper compliance of the law.

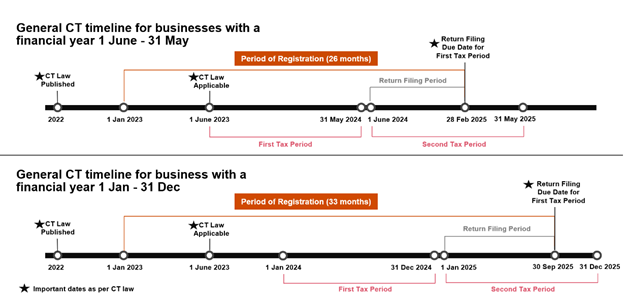

- The law will be effective from June 1st, 2023. If the business follows the financial year from June to May, it will be subject to CT from the financial year June 2023 to May 2024. If the financial year is January to December, then it will be subject to CT from the financial year January to December 2024. Please review illustration below.

Image credit UAE Ministry of Finance

- All taxpayers are required to register and obtain a CT Registration Number. Tax Return is to be filed and the tax liability to be paid within 9 months, from the end of financial year irrespective of whether profit has been made.

- Losses can be carried forward and can be adjusted to the extent of 75% of taxable income in a year and the balance taxable income will be subject to CT. Balance amount of loss can be carried forward for adjustment into next year. The taxable person cannot claim tax loss relief if the losses are incurred before the commencement of CT and/or before a person becomes a taxable person.

- Dividends, profit distribution from business, capital gain and income of foreign branches of UAE entities will be exempt from CT.

- The entities which are exempted from CT includes Federal and Emirates’ organisations, wholly owned Governments’ organisations carrying out mandated business activities, approved public benefits entities, approved investment funds, approved public and private pension or social security funds and businesses engaged in extraction of natural resources and related non-extractive activities which are subject to Emirate level taxation.

- All Free Zone Entities will be required to register and file a CT return. However, such entities are exempt from tax (subject to conditions) on Qualifying Income. On non-qualifying income, a 9% tax will be charged.

- If a foreign person has a fixed or permanent place of business or habitually exercise authority to conduct business in UAE or the income is derived from activities performed, or from assets located or capital invested or rights used or services performed or benefits accrued in UAE, such income will be generally considered as UAE sourced income and will be subject to tax.

- Taxable persons are required to maintain proper accounting records and prepare financial statements as per international accounting standards after making certain adjustments of revenue and expenses as defined in the law to determine Taxable Income. Taxable persons must maintain all records and documents for seven years following the end of the tax period.